Sarasota Real Estate Market 2025: Facts vs Fear

Is the Sarasota real estate market 2025 crashing?

That’s the headline. That’s the fear.

Here are the facts.

When you zoom out beyond click-bait and look at real numbers — before COVID, during the migration surge, and today — the picture changes fast.

The Sarasota real estate market 2025 is not collapsing. It is reverting to the mean after an unsustainable spike.

People became conditioned to historic highs, so anything lower feels like a crash. It isn’t. Context matters.

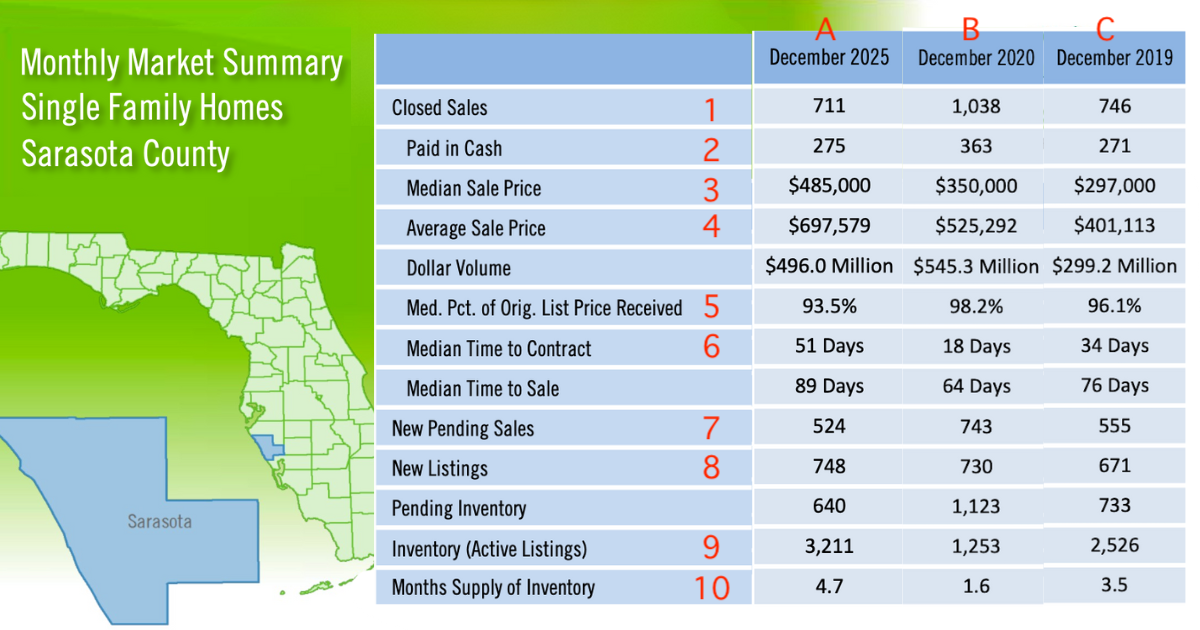

Single-Family Homes — Facts vs Fear (Dec 2019 vs Dec 2020 vs Dec 2025)

Look at the single-family chart across three anchor points:

December 2019 = last normal year

December 2020 = COVID migration frenzy

December 2025 = today

The claim: “Sarasota housing is crashing.”

The data: Sarasota SINGLE-FAMILY home market is normalizing.

Pricing — The Floor Moved Up

Median Sale Price

2019: $297,000

2020: $350,000

2025: $485,000

Still far above pre-COVID despite cooling from 2022 highs

Average Sale Price

2019: $401,113

2025: $697,579

Fear: “Prices are down.”

Fact: Prices are down from the spike, not from reality.

Inventory — Scarcity Ended, Oversupply Did Not Begin

Active Listings

2019: 2,526

2020: 1,253 (artificial shortage)

2025: 3,211

Months Supply of Inventory

2019: 3.5 months

2020: 1.6 months (extreme seller’s market)

2025: 4.7 months (still below the ~6-month balance point)

Fear: “Inventory is exploding.”

Fact: Inventory is returning to rational levels.

Pace & Negotiation — Buyers Think Again

Median Time to Contract: 34 → 18 → 51 days

Median Time to Sale: 76 → 64 → 89 days

% of Original List Price Received: 96.1% → 98.2% → 93.5%

Fear: “Homes aren’t selling.”

Fact: Homes are selling without bidding wars.

Sales Activity — Stable, Not Vanishing

Closed Sales: 746 → 1,038 → 711

New Listings: 671 → 730 → 748

Bottom line:

2020 was the anomaly.

2025 resembles 2019 behavior with a permanently higher price floor.

That is reversion to the mean — not a crash.

Single-Family Homes — 2019 vs 2025 Annual Gain Reality

Now strip out the frenzy year and compare December 2019 to December 2025 directly.

Median Price: $297,000 → $485,000

That equates to roughly +7–9% annualized appreciation over six years.

Key takeaways:

•Prices cooled from 2022 highs — they did not rewind to 2019

•Inventory rose modestly — not excessively

•Days on market increased — not stalled

•Closed sales nearly match 2019 — not disappearing

Fear narrative: “If prices aren’t rising like 2021, the market is broken.”

Reality: Annual gains reverted to historical norms while staying well above pre-COVID values.

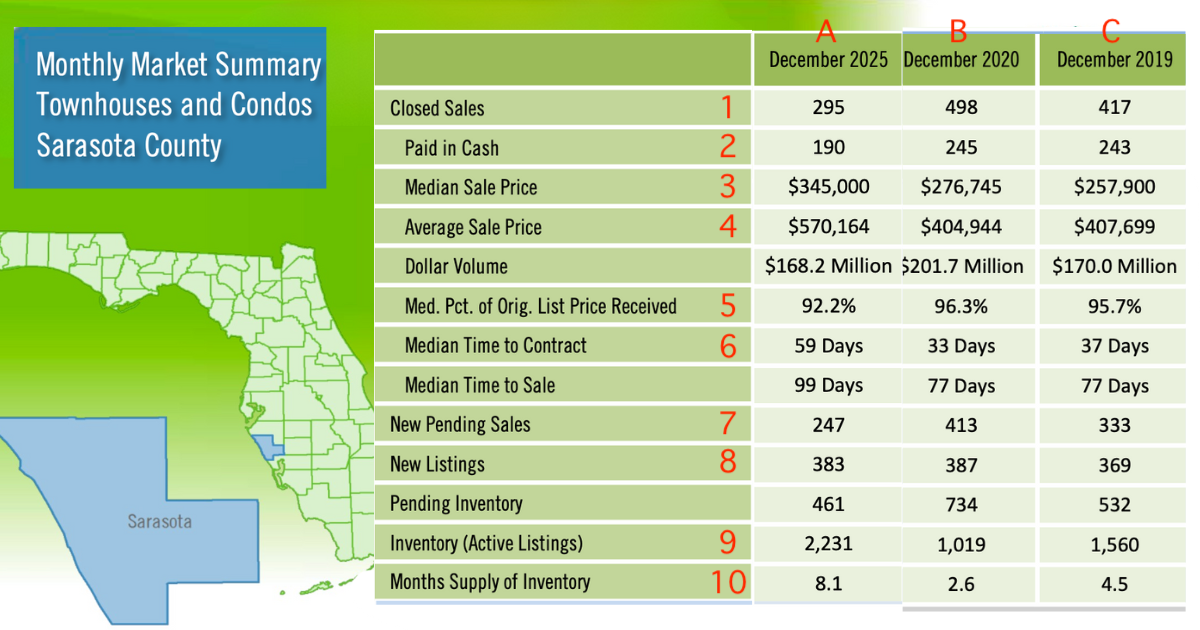

Condos & Townhouses — Facts vs Fear (Dec 2019 vs Dec 2020 vs Dec 2025)

Now the blunt truth: Condos are hit harder than single-family homes.

Townhouses, unfortunately, get lumped into condo data, which muddies nuance, but the pressure is real.

Pricing — Still Above 2019, Softer Than Single-Family Homes

Median Sale Price

2019: $257,900

2020: $276,745

2025: ~$345,000

Appreciation exists, but less aggressive than single-family

Inventory — Buyer Leverage Increased

Active Listings

2019: ~2,300–2,400 units

2025: ~3,800–4,000 units

Months Supply of Inventory

2019: ~4 months

2025: ~8+ months

Fear: “Condos are collapsing.”

Fact: Condos have higher supply and longer marketing times — not zero demand.

Pace & Negotiation

Median Time to Contract: ~45–50 → ~70–80 days

Median Time to Sale: ~80–85 → ~105–115 days

% of List Price Received: ~95–96% → ~90–92%

Translation: Buyers negotiate. Sellers compete. That’s a buyer-leaning segment, not a dead one.

Why Condos Face More Headwinds Than Homes

These pressures did not exist in 2019:

•Surfside (Champlain Towers South) collapse → structural inspection & reserve laws

•Insurance spikes for both master and unit policies

•2024 storm season → more insurance pressure + special assessments

•HOA fee increases

•Part-time ownership reality — many owners are seasonal, easier to sell or pause

This combination produced:

•More listings

•More hesitation

•Slower absorption

•Corporate/legacy media responded with sweeping headlines like “Florida Real Estate Is Crashing.”

That narrative ignores local nuance and lumps single-family homes and villas together with condos — which are different markets.

Condos & Townhouses — 2019 vs 2025 Annual Gain Reality

Even with the headwinds:

- Median Price: $257,900 → ~$345,000

- Appreciation remains positive since 2019

- Growth is softer, but not erased

- Inventory expanded, but not infinite

Key distinction:

- Single-family normalization = primarily economic

- Condo normalization = economic + regulatory + insurance + perception

The Real Conclusion — Facts Over Fear About the Sarasota Real Estate Market 2025

The Sarasota real estate market 2025 is not a collapse story.

It is a context story.

>Single-family homes: reverting to historical norms with strong long-term gains intact.

>Condos: facing legitimate headwinds, yet still above pre-COVID pricing.

>Inventory: higher than frenzy years, still rational.

>Buyers: analytical instead of emotional.

>Sellers: competing instead of dictating.

The spike misled people.

The cooldown scared people.

The data clarifies the truth.

Facts vs Fear.

When you look at the charts — not the headlines — Sarasota County real estate is doing what healthy markets always do after a sprint:

It’s catching its breath, not falling apart.

Important context: Absolutely, the people who purchased between late 2020-2024 are likely “underwater,” i.e. they paid more than their homes are worth today.

That’s an unfortunate reality/likelihood.

If you are a reasonable person who studies the available data and makes your own conclusions, then you & I should talk if you have questions or concerns about purchasing or selling a property in Sarasota County.

I don’t expect you to trust these charts (straight from the Sarasota Association of Realtors) or me. I’ve not earned your trust…yet.

Love This Post? Share It!

Hi, I’m Mike – real estate agent, photographer, and blogger. Come along as I dive into all things Sarasota, Florida, share insider tips and exciting stories that make this place special. For 20+ years, I’ve helped countless people buy and sell property. Before I transitioned to full-time real estate, I taught high school English & coached basketball.”